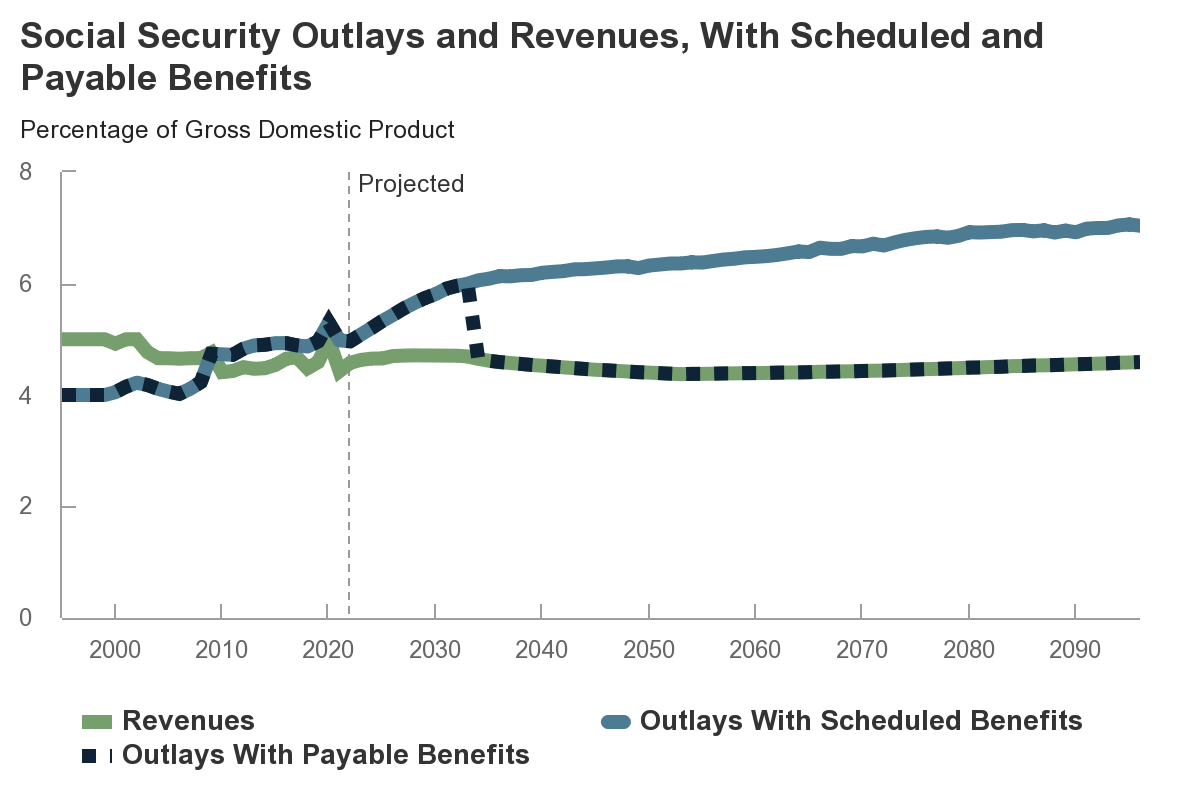

The Congressional Budget Office’s long term projections for Social Security show a reduction in benefits as soon as 2033.

In this report, the Congressional Budget Office describes its long-term projections for Social Security. One set of projections reflects a scenario in which the program continues to pay benefits as scheduled under current law, regardless of whether the program’s trust funds have sufficient balances to cover those payments. If the gap between the trust funds’ outlays and income occurs as CBO projects, then the balance in the trust funds will decline to zero in 2033 and the Social Security Administration will no longer be able to pay full benefits when they are due. Therefore, another set of projections reflects a scenario in which Social Security outlays are limited to what is payable from annual revenues (from payroll taxes and from income taxes on benefits) after the trust funds are exhausted.

- Social Security’s Finances, With Scheduled Benefits. CBO projects that if Social Security paid benefits as scheduled, spending on the program would increase from 5.0 percent of gross domestic product (GDP) in 2022 to 7.0 percent in 2096, and revenues would remain around 4.6 percent of GDP over the same period. The Old-Age and Survivors Insurance Trust Fund would be exhausted in 2033, and the Disability Insurance Trust Fund would be exhausted in 2048. If the trust funds were combined, their exhaustion date would be in 2033.

In CBO’s projections, Social Security’s actuarial deficit over the next 75 years is equal to 1.7 percent of GDP, or 4.9 percent of taxable payroll. That is, the federal government could maintain the necessary trust fund balances through 2096 if it immediately, and permanently, raised payroll tax rates by about 4.9 percentage points (or implemented an equivalent reduction in benefits or combination of tax increases and benefit reductions). After 2096, however, the gap between revenues and outlays would widen, and shortfalls would continue to increase.

- Distribution of Scheduled Benefits and Payroll Taxes. In CBO’s projections, average retirement and disability benefits in the first full year of claiming increase over time because of growth in average earnings. For example, initial benefits for retired workers born in the 1990s (who turn 65 beginning in 2055) are larger, on average and after adjusting for the effects of inflation, than for earlier cohorts. However, initial benefits replace a similar share of past earnings for successive cohorts. Payroll taxes paid over the lifetime, measured as a percentage of lifetime earnings, also do not change much for successive cohorts. Within cohorts, people with higher earnings generally receive larger benefits and pay a smaller share of lifetime earnings as payroll taxes than people with lower earnings.

- Social Security’s Finances, With Payable Benefits. CBO projects that if Social Security outlays were limited to what is payable from annual revenues after the trust funds’ exhaustion in 2033, Social Security benefits would be about 23 percent smaller than scheduled benefits in 2034. They would be 35 percent smaller by 2096, and the gap would remain stable thereafter.

- Distribution of Payable Benefits. After the trust funds’ exhaustion in the payable-benefits scenario, average retirement benefits in the first year of claiming resume their growth, but those benefits are smaller than scheduled benefits for people born after 1968 (that is, those who turn 65 after 2033).

Download the full report here.

Congressional Budget Office’s long term projections for Social Security